amazon flex take out taxes

If you still cannot log into the Amazon Flex app. Gig Economy Masters Course.

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

The other federal tax that youll need to pay is income tax.

. Does Amazon Flex take out federal and state taxes. This video shares information on where to find your 1099 expenses you should take into account to reduce your taxable i. I did flex full time in 2017 made about 30k and after deductions Ill owe around 27k.

Knowing your tax write offs can be a good way to keep that income in your pocket. This is the non-employee compensation 1099 form you receive from Amazon Flex if you earn at least 600 with them if it is under 600 you will not receive the form -- but. Its a progressive tax which means that the amount of tax youll owe depends on your income.

Most drivers earn 18-25 an hour. Increase Your Earnings. Amazon Flex quartly tax payments Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C.

No matter what your goal is Amazon Flex helps you get there. Your mileage comes right out of income on your 1099 before you take any deductions. If you are using your own car for Amazon then you can choose to claim an amount for the number of miles you drive.

Tap Forgot password and follow the instructions to receive assistance. Amazon Flex will not withhold income tax or file my taxes for me. As a self-employed independent contractor you will have to pay taxes and self-employment tax on your.

The forms are also sent to the IRS so take note if youve made more than 600. Answered December 24 2017. Youre suppose to pay quarterly which I will now dropping 27k nearly all at.

Asked October 10 2017. Having more money in your pocket. Self-employed individualslike Amazon FlexFBA workerscan deduct their.

Or download the Amazon Flex app. Its almost time to file your taxes. Driving for Amazon flex can be a good way to earn supplemental income.

They are responsible for paying their taxes at the end the tax year. Select Sign in with Amazon 3. Amazon Flex drivers receive 1099-NEC forms from the company according to online reports.

Claiming for a Car on Amazon Flex Taxes. No You are an Independent Contractor. Understand that this has nothing to do with whether you take the standard deduction.

Amazon Flex doesnt take out taxes on your behalf. Tracking your mileage and expenses is the key to saving on taxesaka. Amazon Flex drivers are self-employed.

Sign out of the Amazon Flex app. Beyond just mileage or car.

Amazon Flex Taxes Documents Checklists Essentials

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

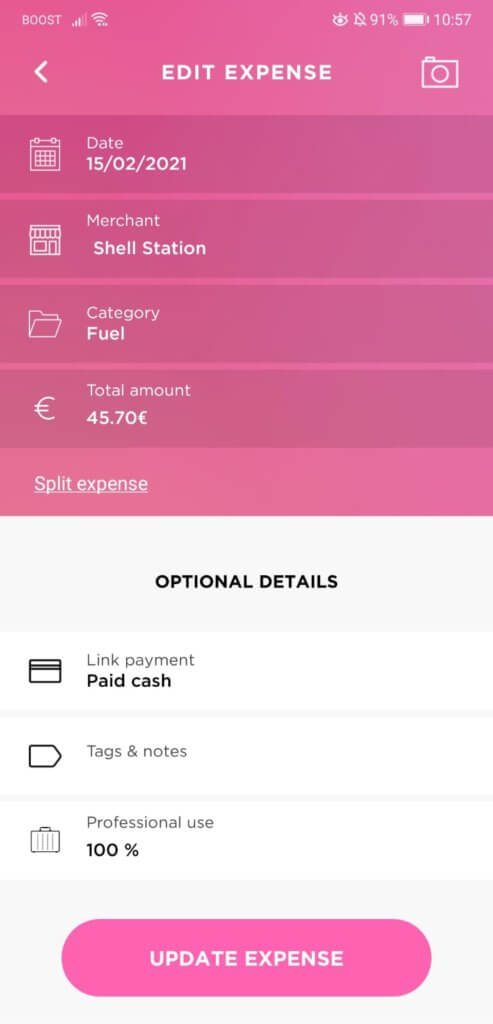

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Amazon Sales Tax Accounting Tips For Amazon Sellers

Income Strategies How To Create A Tax Efficient Withdrawal Strategy To Generate Retirement Income William Reichenstein 9780578555089 Amazon Com Books

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Does Amazon Flex Take Out Taxes Find Out Answerbarn

How To File Amazon Flex 1099 Taxes The Easy Way

Does Amazon Flex Take Out Taxes In 2022 Complete Guide

![]()

Triplog Automatic Mileage Tracking Made Easy

How To Do Taxes For Amazon Flex Youtube

How To File Self Employment Taxes Step By Step Your Guide

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Amazon Sales Tax A Compliance Guide For Sellers Sellics

2021 Daily Income Mileage Toll And Taxes Tracker For Etsy In 2022 Daily Expense Tracker Rideshare Income