michigan gas tax increase history

Michigan fuel purchases are also subject to the 6 state sales tax. Gasoline and Diesel Tax rates also include a 8-875 cpg state sales tax 4 local sale tax rate most areas Other Tax include a 005 cpg Petroleum Test Fee gas onlyand a 030 cpg spill fee State excise tax is 8 cpg on gasoline and diesel Petroleum Business Tax 178 cpg gas only and 1605 cpg diesel article 13A North Dakota.

Michigan Gas Tax Going Up January 1 2022

Michigan is one of six states that impose a sales tax on gasoline.

.png)

. Also it would more than double the current 15-cent tax on diesel. Didnt gas taxes just go up. Under the plan Michigans current 19-cent per gallon tax on gasoline would increase to 24 cents in October 2015 29 cents in January 2016 and a final 34 cents in January 2017.

0219 gallon Most jet fuel that is used in commercial transportation is 044gallon. Hohman was referring in part to the 45-cent per gallon gas tax proposed by Gov. 1 2017 as a result of the 2015 legislation.

Had the gas tax been adjusted for inflation it. The 187 cents per gallon state gas tax and the 184 cents per gallon federal fuel tax. Many residents were not happy to hear Gov.

These tax rates are based on. 10 In fact gas taxes accounted for about one-fifth of the 250 average price for a. Most states tax motor fuels with a per unit tax such as the 263 cents per gallon levied by Michigan.

Throw in the 184-cent federal tax and it starts to add up. Michigan currently operates three toll bridges. Michigan may levy a gasoline tax.

There are no toll roads in Michigan while 28 other states collect revenue from toll roads. As of January of this year the average price of a gallon of gasoline in Michigan was 237. According to Whitmer the tax increase will help fix the crumbling roads.

When gas is 389. Why are we paying such high gas taxes for crumbling roads. When Michigans tax and fee increases take effect in January 2017 they will be the states first fuel tax hike in 20 years and the first major vehicle fee hike since 1983 when it switched from.

Included in the Gasoline DieselKerosene and Compressed Natural Gas rates is a 01 per gallon charge for the Leaking Underground Storage Tank Trust Fund LUST. In addition to state gas taxes which can make up between 5 percent and more than 20 percent of the cost of gas the federal government levies a tax of 184 cents per gallon 247 Wall St. This may well bring the annual increase close to the 5 maximum if not higher.

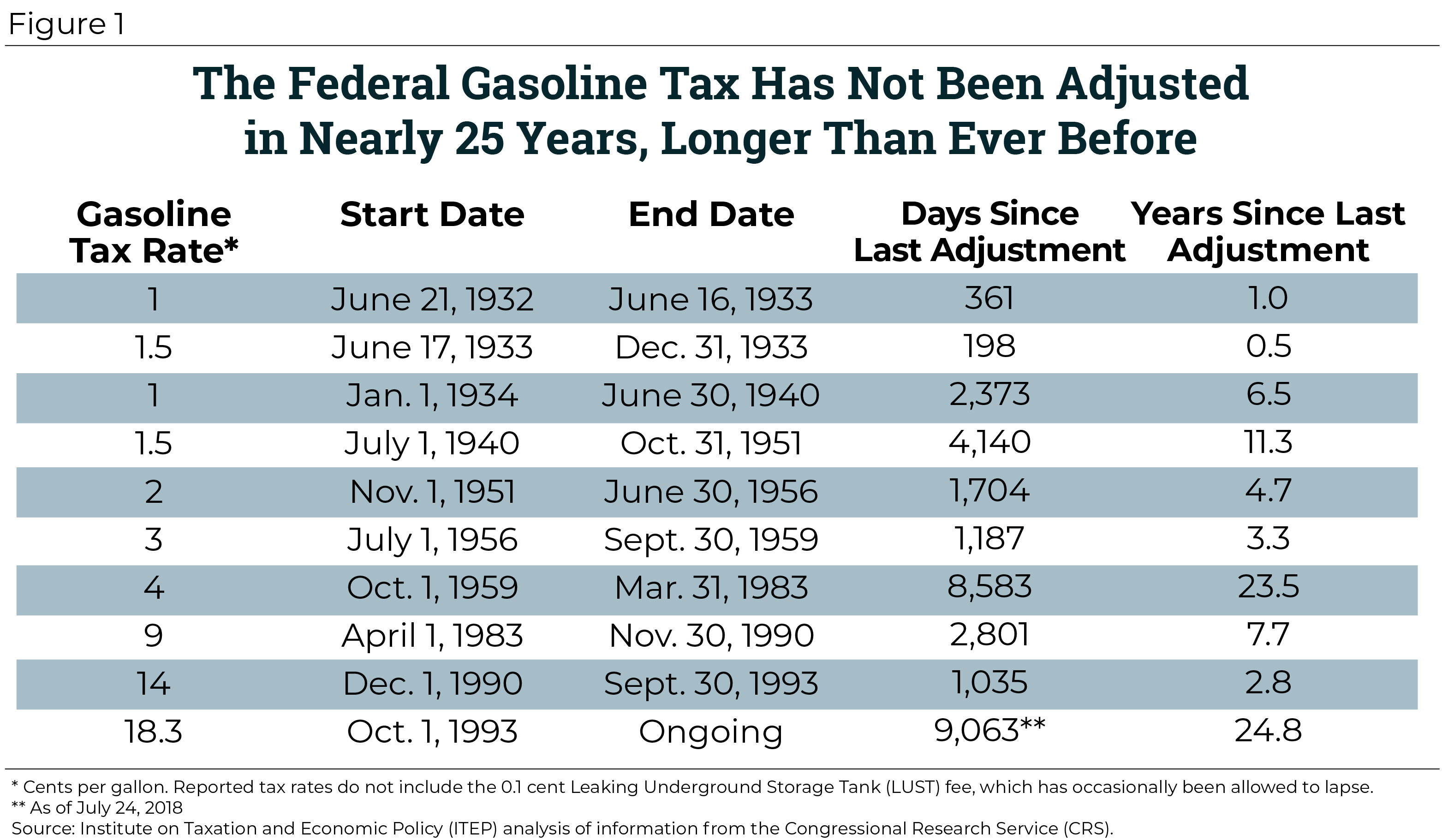

From 1956 until 1993 Congress regularly increased gas taxes from an initial 3 cents a gallon to the current 184 cents. Beonica Smith a local. Gretchen Whitmers proposed 45-cent gas tax increase.

Getting gas can be pricy depending on the vehicle and oil market but in Michigan drivers could be forced to shell out more at the station if a. Michigans diesel fuel tax was adopted in 1947 at a rate of five cents per gallon. At that rate Michigan motorists would pay 76 million more in the state gas tax each year starting in 2022.

The gasoline tax of 19 cents a gallon will increase by 73 cents and the diesel tax of 15 cents a gallon will go up 113 cents with automatic annual inflationary adjustments in. But you also pay the Michigan 6 per - cent sales tax. The federal governments 184 cent gas tax for example has not increased in over twenty-three years.

Looking ahead Michigan is poised to join the growing number of states that index their fuel taxes to inflation starting in 2022. And the states gas tax as a share of the total cost of a gallon of gas stood at 177 percent. Compressed Natural Gas CNG 0184 per gallon.

Motorists here already pay the 184 cent per gallon federal gas tax. Michigans gas tax is currently 263 cents per gallon for both regular and diesel fuel. Gas and diesel tax rates vary each month in Michigan alongside changes in the price of fuel.

Whitmers proposed three-step increase over a one-year. Michigan local governments received over 15 billion of Michigan Department of Transportation transfers in FY 2014-15 451 percent of the. Gretchen Whitmer as part of her attempt to raise more than 25 billion to honor her 2016 campaign promise to fix.

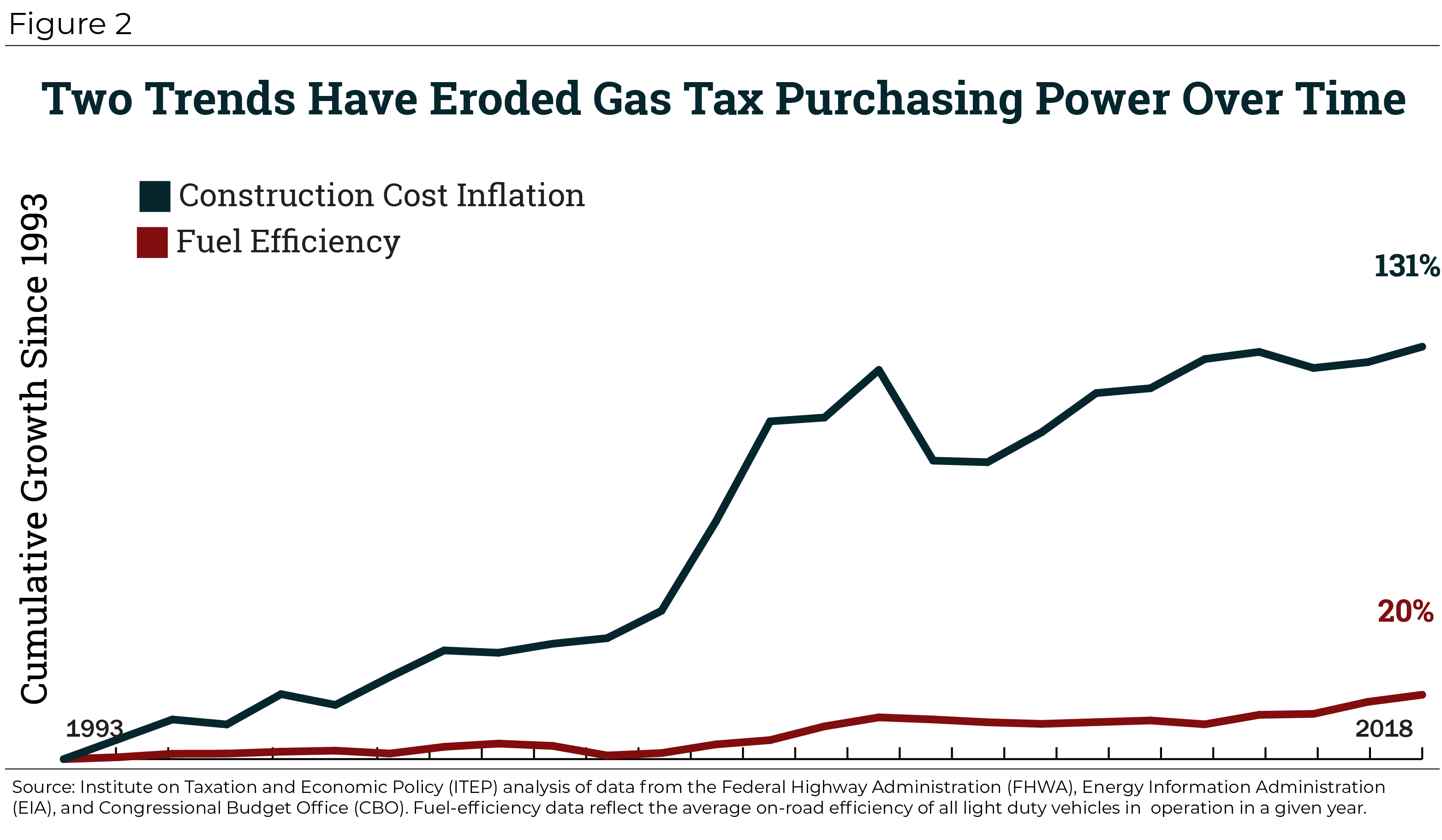

Thirty states and the federal government levy fixed-rate gas taxes where the tax rate does not change even when the cost of infrastructure materials rises or when drivers transition toward more fuel-efficient vehicles and pay less in gas tax. Whitmer proposed a 45-cent gas tax increase to help fix. Starting January 1 2017 gas taxes will increase 73 cents and diesel will go up 113 cents.

Whether gas costs 2 per gallon or 4 per gallon the amount collected for those two taxes remains the same. The current federal motor fuel tax rates are. Two years later in 1927 the rate was increased to three cents per gallon.

Michigan first enacted a fuel tax in 1925 at a rate of two cents per gallon. Michigan fuel taxes last increased on Jan. This is the first increase in fuel tax in 20 years.

Many Michigan residents ask the question every pothole season. Michigan youre paying a couple of road-user fees as well. On July 1 the gas tax will increase by 01 cents and the diesel tax by 02 cents.

.png)

Map State Gasoline Tax Rates Tax Foundation

Gas Taxes Rise In A Dozen States Including An Historic Increase In Illinois Itep

U S States With Highest Gas Tax 2021 Statista

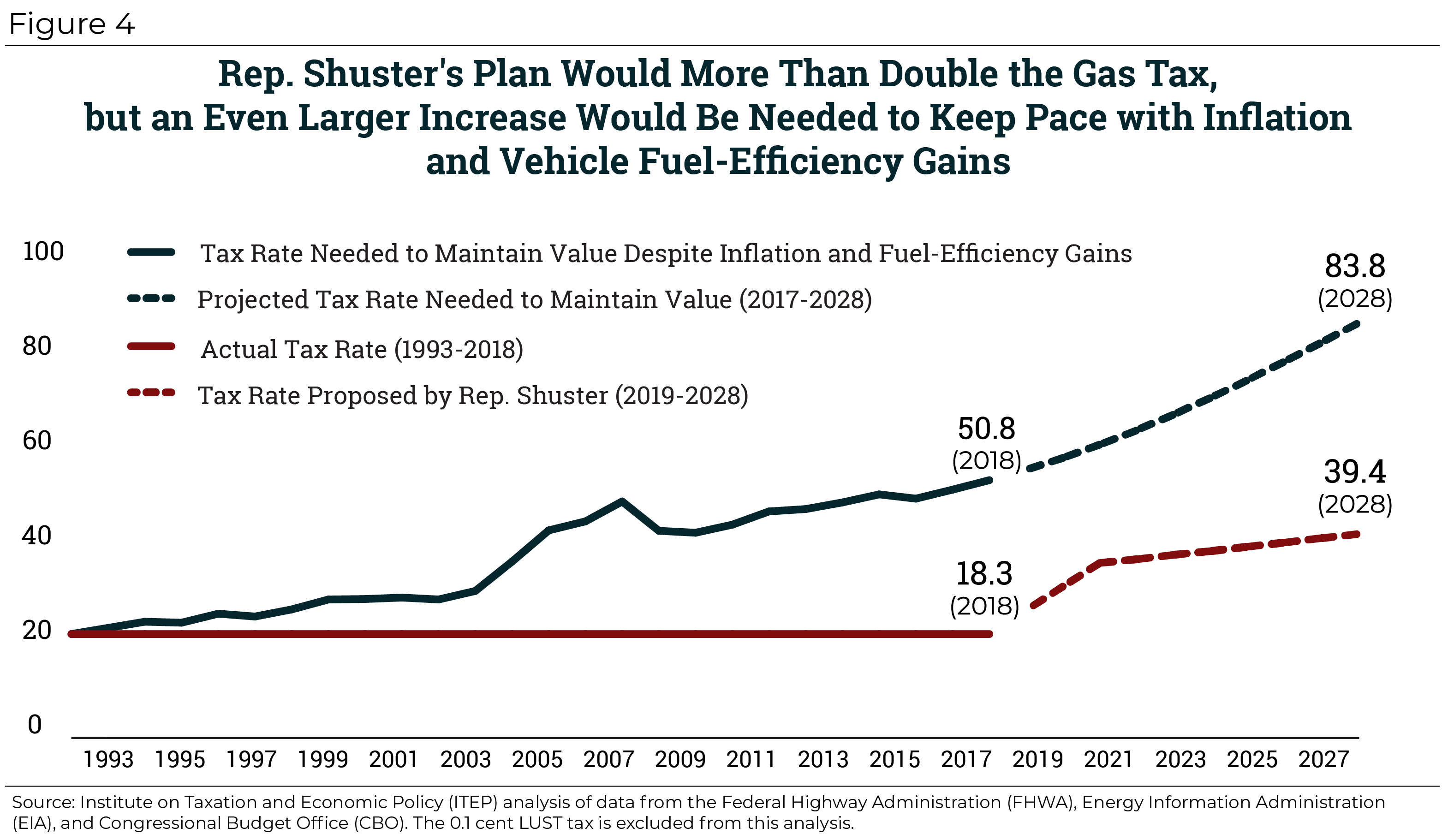

Rep Shuster S Mixed Bag Doubling The Gas Tax Before Repealing It Entirely Itep

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

Driving Through Gas Taxes Carbontax Undergroundstoragetank Map Gas Tax Best Airfare Deals

State Motor Fuel Tax Rates The American Road Transportation Builders Association Artba

Rep Shuster S Mixed Bag Doubling The Gas Tax Before Repealing It Entirely Itep

Rep Shuster S Mixed Bag Doubling The Gas Tax Before Repealing It Entirely Itep